The global solar energy market stands poised for unprecedented growth, with projections indicating a compound annual growth rate (CAGR) of 20.5% from 2023 to 2030. Driven by falling installation costs, innovative financing solutions, and aggressive climate policies worldwide, solar power has emerged as the fastest-growing renewable energy sector. Industry analysts forecast the market value to reach $373.84 billion by 2030, reflecting a transformative shift in the energy landscape.

Recent technological breakthroughs in photovoltaic efficiency and energy storage solutions have dramatically improved solar power’s commercial viability. Corporate investments in solar infrastructure reached record levels in 2022, with major enterprises committing to ambitious renewable energy targets. This surge in commercial adoption, coupled with supportive government incentives and environmental regulations, creates a compelling market environment for stakeholders across the value chain.

For decision-makers in commercial real estate and industrial sectors, understanding these market dynamics is crucial. The convergence of declining costs, improved technology, and favorable policies presents an unprecedented opportunity to capitalize on solar energy’s growth trajectory while achieving significant operational cost savings and sustainability goals.

Current Market Trends Driving Solar Adoption

Policy and Incentive Landscape

Government support continues to play a pivotal role in driving solar energy adoption worldwide. The Investment Tax Credit (ITC) in the United States remains a cornerstone policy, offering a 30% tax credit for solar installations through 2032. The Inflation Reduction Act of 2023 has further strengthened these incentives, introducing additional benefits for projects meeting domestic content requirements and serving low-income communities.

At the state level, diverse policy mechanisms such as Renewable Portfolio Standards (RPS) and Solar Renewable Energy Credits (SRECs) create market demand and financial opportunities. Net metering policies, adopted by 38 states, enable businesses to maximize their solar investment returns by selling excess power back to the grid.

Globally, feed-in tariffs and auction systems have proven successful in countries like Germany, China, and Australia. The European Union’s Green Deal includes ambitious solar targets, backed by simplified permitting processes and financial support mechanisms. Emerging markets are following suit, with India’s production-linked incentive scheme attracting manufacturing investments.

Corporate tax benefits, accelerated depreciation allowances, and green building certifications provide additional motivation for commercial solar adoption. These policy frameworks, combined with declining technology costs, create a favorable environment for solar energy investment and market growth.

Technology Advancements and Cost Reductions

Recent technological breakthroughs in solar panel efficiency and manufacturing processes have significantly reduced implementation costs across the industry. Modern solar panels now regularly achieve efficiency rates of 20-22%, with premium models reaching up to 25%, marking a substantial improvement from the 15% efficiency standard of a decade ago.

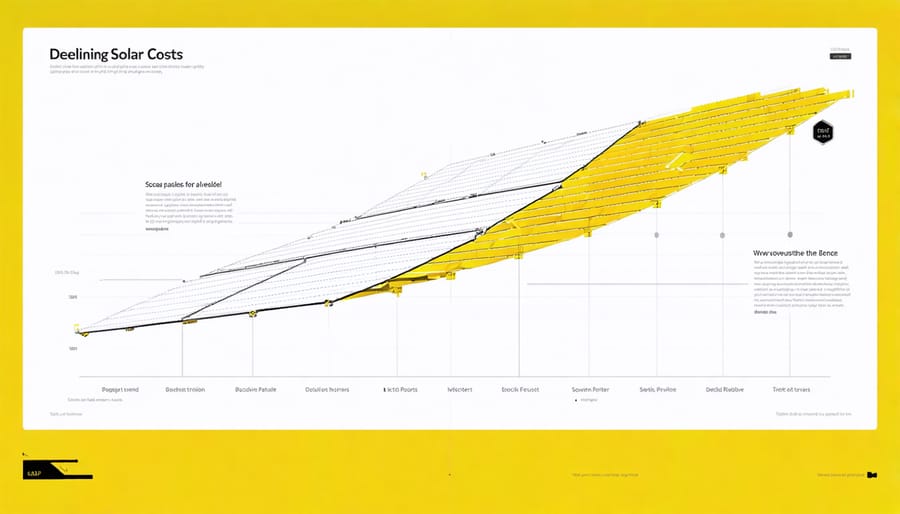

Manufacturing innovations, particularly in silicon wafer production and automated assembly lines, have driven down production costs by approximately 85% since 2010. Current market trends indicate installation costs averaging $2.50 per watt for commercial systems, compared to $7.34 per watt in 2010. This decline is projected to continue, with experts forecasting an additional 20-30% reduction by 2025.

Emerging technologies, such as bifacial panels and perovskite solar cells, promise even greater efficiency gains. Bifacial panels, which capture sunlight on both sides, can increase energy yield by 5-15% compared to traditional panels. Meanwhile, advanced energy storage solutions have become more affordable, with lithium-ion battery costs declining by 89% since 2010.

These technological improvements, combined with streamlined installation processes and economies of scale, have made solar energy increasingly competitive with traditional power sources, accelerating market adoption across commercial and industrial sectors.

Commercial Real Estate Market Projections

Short-term Growth Expectations (2024-2025)

The solar energy market is poised for significant expansion in 2024-2025, with analysts projecting a compound annual growth rate (CAGR) of 20.5% during this period. Key drivers include declining solar panel costs, which are expected to decrease by an additional 15% by 2025, and increased government incentives across major markets.

Corporate adoption of solar energy is anticipated to surge, with Fortune 500 companies pledging to double their renewable energy procurement by 2025. The commercial and industrial sectors are expected to witness particularly strong growth, driven by rising electricity costs and corporate sustainability mandates.

Market indicators suggest that utility-scale solar installations will increase by 30% year-over-year, with distributed generation showing similar momentum. Supply chain improvements and technological advancements in solar panel efficiency are expected to accelerate project completion times and enhance return on investment metrics.

Emerging trends include the rapid adoption of bifacial solar panels, which are projected to capture 35% of the market share by 2025, and the integration of artificial intelligence in solar energy management systems. The energy storage segment is expected to grow in tandem, with battery costs predicted to fall by 25% during this period.

Regional markets showing the strongest growth potential include the Asia-Pacific region, North America, and emerging economies in Latin America, where favorable policies and increasing energy demand are driving solar adoption.

Mid-term Market Evolution (2026-2028)

The mid-term solar energy market is projected to experience significant transformation between 2026 and 2028, with compound annual growth rates expected to exceed 15%. Commercial installations are forecasted to dominate market expansion, driven by improved energy storage solutions and enhanced grid integration capabilities.

Technology adoption rates will accelerate as manufacturing costs continue to decrease, with bifacial solar panels expected to capture 40% of new installations by 2027. Smart inverter technology integration will reach an estimated 75% market penetration, enabling better grid stability and energy management.

Corporate procurement of solar energy will likely double during this period, as more businesses commit to renewable energy targets. The commercial and industrial sectors are projected to add 45-50 GW of new solar capacity annually, supported by favorable policies and improved financing options.

Energy storage integration will become standard in most commercial installations, with prices expected to fall below $100/kWh by 2027. This price point represents a critical threshold for widespread adoption across various market segments.

Emerging markets will see particularly strong growth, with India and Southeast Asian nations projected to account for 30% of global installations. Building-integrated photovoltaics (BIPV) will gain significant traction, especially in urban commercial developments, with an expected market share increase from 5% to 15% during this period.

Regional policies and incentive programs will continue to drive market growth, with an increasing focus on commercial-scale installations and virtual power plant networks.

Long-term Industry Transformation (2029-2030)

By 2029-2030, the solar energy market is projected to reach full maturity, characterized by standardized practices and highly efficient technologies. Industry experts forecast that solar technology breakthroughs will drive conversion efficiencies above 40% for commercial applications, while installation costs are expected to decrease by an additional 60% compared to 2024 levels.

The integration of artificial intelligence and machine learning will revolutionize solar asset management, with predictive maintenance becoming the industry standard. Smart grid technologies will evolve to seamlessly handle distributed energy resources, making solar plus storage systems the backbone of commercial power infrastructure.

Market consolidation will likely result in fewer but more sophisticated solar providers, offering comprehensive energy management solutions. Commercial building codes worldwide are expected to mandate solar installation, creating a steady demand stream. Additionally, the emergence of solar-as-a-service business models will dominate the market, allowing businesses to access solar benefits with minimal upfront investment.

The secondary market for solar assets will mature, creating new financial instruments and investment opportunities. Manufacturing will shift toward fully automated facilities, reducing production costs while increasing quality control. These developments will establish solar energy as the primary power source for commercial and industrial applications, with an estimated 70% of commercial buildings utilizing solar power systems by 2030.

Investment Returns and Financial Benefits

Energy Cost Savings Analysis

The financial impact of solar energy adoption continues to demonstrate compelling returns, with businesses reporting significant reductions in operational costs. Recent market analysis indicates that commercial solar installations can reduce energy expenses by 40-75% over their lifetime, delivering substantial business sustainability ROI through reduced utility bills and maintenance costs.

Organizations implementing solar solutions typically experience payback periods of 3-7 years, depending on facility size and energy consumption patterns. Large-scale commercial installations can expect annual savings between $30,000 and $100,000, with additional benefits from government incentives and tax credits. The levelized cost of electricity (LCOE) for solar has decreased by approximately 85% over the past decade, making it increasingly competitive with traditional energy sources.

Energy storage solutions paired with solar installations can further optimize cost savings by reducing peak demand charges and providing backup power capabilities. Smart energy management systems enable businesses to maximize their solar investment by automatically adjusting consumption patterns to align with peak production periods.

Maintenance costs for solar installations remain minimal, typically requiring annual inspections and occasional panel cleaning. With warranties extending 25-30 years and panel degradation rates of only 0.5% annually, businesses can rely on consistent energy production and predictable cost savings throughout the system’s lifetime.

Property Value Enhancement

Solar installations have emerged as a significant driver of commercial property value enhancement, with studies showing an average increase of 3-8% in property valuations following solar system implementation. This value appreciation stems from multiple factors, including reduced operational costs, enhanced environmental credentials, and improved building performance ratings.

Commercial properties with solar installations demonstrate particularly strong appreciation in markets with high electricity costs and robust renewable energy incentives. Recent market analyses indicate that buildings with solar installations command premium lease rates and experience shorter vacancy periods compared to non-solar properties. This trend is especially pronounced in Class A office buildings and industrial facilities, where energy costs represent a significant portion of operating expenses.

The impact on property value is further amplified by green building certifications, which often incorporate solar installations as a key component. Properties achieving LEED, BREEAM, or similar certifications typically command 10-20% higher valuations than their conventional counterparts. Additionally, solar-equipped properties benefit from enhanced marketability, as corporate tenants increasingly prioritize sustainability in their facility selection criteria.

Insurance companies and financial institutions are also recognizing the value-add of solar installations, often offering preferential terms for solar-equipped properties due to their reduced operational risks and enhanced resilience. This financial advantage contributes to improved property performance metrics and higher overall asset values in commercial real estate portfolios.

Strategic Implementation Considerations

Successful implementation of solar energy systems in commercial properties requires careful consideration of several strategic factors. Property owners and facility managers must first conduct comprehensive site assessments to evaluate roof structural integrity, available space, and optimal panel orientation for maximum solar exposure.

A crucial element is selecting the right system size based on energy consumption patterns and future growth projections. Organizations should analyze historical energy usage data and peak demand periods to determine the optimal system capacity that balances initial investment with long-term returns.

Financial planning plays a vital role in successful transition to solar energy. Companies should explore available incentives, tax credits, and financing options while developing a clear ROI timeline. Many organizations find success with phased implementation approaches, allowing for controlled scaling of solar installations as budgets and needs evolve.

Infrastructure readiness is another critical consideration. This includes evaluating existing electrical systems, installing necessary monitoring equipment, and ensuring compliance with local building codes and utility requirements. Organizations should also establish maintenance protocols and identify qualified service providers for ongoing system support.

Stakeholder engagement is essential for project success. This involves educating employees about solar benefits, training facility staff on system operations, and maintaining clear communication with utility providers throughout the implementation process. Additionally, organizations should develop contingency plans for power management during installation and potential system downtime.

By addressing these key implementation factors, commercial properties can maximize the benefits of their solar energy investments while minimizing potential disruptions to business operations.

The solar energy market demonstrates robust growth potential through 2030, with projections indicating a compound annual growth rate of 20.5%. Commercial property owners who act now stand to benefit from declining installation costs, improved technology efficiency, and expanding government incentives. Market analysis suggests that early adopters will secure the most favorable ROI, with typical payback periods shortening from 7-10 years to 4-6 years by 2025.

To capitalize on these market trends, commercial property owners should take several strategic steps. First, conduct a comprehensive site assessment to determine solar potential and energy needs. Second, evaluate financing options, including Power Purchase Agreements (PPAs), solar leases, and direct ownership models. Third, engage with qualified solar installers and consultants to develop customized implementation plans that align with business objectives and building specifications.

The forecast indicates that solar technology costs will continue to decrease while efficiency improves, making it an increasingly attractive investment for commercial properties. Energy storage solutions are becoming more affordable and sophisticated, enhancing the overall value proposition of solar installations. Property owners who implement solar solutions now will likely see enhanced property values, reduced operating costs, and improved tenant satisfaction.

Success in the evolving solar market requires careful planning, strategic timing, and partnership with experienced providers. By taking action today, commercial property owners can position themselves advantageously in an increasingly competitive and sustainable energy landscape.